| (2) | Audit fees consist of (i) 4% of the total number of shares of Common Stock outstanding on December 31 of the preceding year, (ii) 7,311,356 shares of Common Stock (subject to adjustmentfees for recapitalizations, stock splits, stock dividends and similar transactions), and (iii) such number of shares of our Common Stock determined by our Board or our Compensation Committee prior to January 1 of a given year. All of the foregoing share numbers are subject to adjustment as necessary to implement any changes in our capital structure (as described below). Shares subject to awards that will be granted under the Equity Incentive Plan that expire or terminate without being exercised in full will not reduce the number of shares available for issuance under the Equity Incentive Plan. The settlement of any portion of an award in cash will not reduce the number of shares available for issuance under the Equity Incentive Plan. Shares of Common Stock withheld under an award to satisfy the exercise, strike or purchase price of an award or to satisfy a tax withholding obligation will not reduce the number of shares that will be available for issuance under the Equity Incentive Plan. With respect to a stock appreciation right, only shares of Common Stock that are issued upon settlement of the stock appreciation right will count towards reducing the number of shares available for issuance under the Equity Incentive Plan. If any shares of our Common Stock issued pursuant to an award are forfeited back to or repurchased or reacquired by us (i) because of a failure to meet a contingency or condition required for the vesting of such shares; (ii) to satisfy the exercise, strike or purchase price of an award; or (iii) to satisfy a tax withholding obligationservices rendered in connection with an award, the shares that are forfeited or repurchased or reacquired will revert toannual audit and again become available for issuance under the Equity Incentive Plan.

Plan Administration

Our Board, or a duly authorized committeequarterly reviews of our Board, administers the Equity Incentive Plan. Our Board, or a duly authorized committeeconsolidated financial statements. Audit fees also consist of our Board, may, in accordance with the terms of the Equity Incentive Plan, delegate to one or more of our officers the authority to (i) designate employees (other than officers) to be recipients of specified awards, and to the extent permitted by applicable law, the terms of such awards; and (ii) determine the number of shares of Common Stock to be subject to such awards granted to such employees. Under the Equity Incentive Plan, our Board, or a duly authorized committee of our Board, will have the authority to determine: award recipients; how and when each award will be granted; the types of awards to be granted; the provisions of each award, including the period of exercisability and the vesting schedule applicable to an award; the number of shares of Common Stock or cash equivalent subject to each award; the fair market value applicable to an award; and the terms of any performance award that is not valued in whole or in part by reference to, or otherwise based on, Common Stock, including the amount of cash payment or other property that may be earned and the timing of payment.

Under the Equity Incentive Plan, (i) our Board will not, without stockholder approval, (a) reduce the exercise or strike price of an option or stock appreciation right (other thanservices provided in connection with a capitalization adjustment), and (b) at any time when the exercise or strike price of an option or stock appreciation right is above the fair market value of a share of Common Stock, cancel and re-grant or exchange such option or stock appreciation right for a new award with a lower (or no) purchase price or for cash, and (ii) a participant’s rights under any award will not be materially adversely impaired by any amendment without the participant’s written consent.

We will also designate a plan administrator to administer the day-to-day operations of the Equity Incentive Plan.

Stock Options

Options will be granted under stock option agreements adopted by our Board. Each option will be designated in writing as an ISO or an NSO. Our Board will determine the exercise price for stock options, within the terms and conditions of the Equity Incentive Plan, except the exercise price of a stock option generally will not be less than 100% (or 110% in the case of ISOs granted to a person who owns or is deemed to own stock possessing more than 10% of our total combined voting power or that of any of our parent or subsidiary corporations, or a ten

percent stockholder) of the fair market value of our Common Stock on the date of grant. Options granted under the Equity Incentive Plan will vest at the rate specified in the stock option agreement as will be determined by our Board. The terms and conditions of separate options need not be identical.

No option will be exercisable after the expiration of ten years (or five years in the case of ISOs granted to a ten percent stockholder) or a shorter period specified in the applicable award agreement. Unless the terms of an optionholder’s stock option agreement, or other written agreement between us and the recipient, provide otherwise, if an optionholder’s service relationship with us or any of our affiliates ceases for any reason other than disability, death or cause, the optionholder may generally exercise any vested options for a period of three months following the cessation of service. If an optionholder’s service relationship with us or any of our affiliates ceases due to death, or an optionholder dies within a certain period following cessation of service, the optionholder or a beneficiary may generally exercise any vested options for a period of 18 months following the date of death. If an optionholder’s service relationship with us or any of our affiliates ceases due to disability, the optionholder may generally exercise any vested options for a period of 12 months following the cessation of service. In the event of a termination for cause, options generally terminate upon the termination date. An optionholder may not exercise an option at any time that the issuance of shares upon such exercise would violate applicable law. Unless provided otherwiseErnst & Young LLP’s consents that were included in the optionholder’s stock option agreement or other written agreement between an optionholder and us, if an optionholder’s service relationship with us or any of our affiliates ceases for any reason other than for cause and, at any time during the last thirty days of the applicable post-termination exercise period: (i) the exercise of the optionholder’s option would be prohibited solely because the issuance of shares of Common Stock upon such exercise would violate applicable law, or (ii) the immediate sale of any shares of Common Stock issued upon such exercise would violate our trading policy, then the applicable post-termination exercise period will be extended to the last day of the calendar month that begins after the date the award would otherwise expire, with an additional extension of the exercise period to the last day of the next calendar month to apply if any of the foregoing restrictions apply at any time during such extended exercise period. There is no limitation as to the maximum permitted number of extensions. However, in no event may an option be exercised beyond the expiration of its term.

Acceptable consideration for the purchase of Common Stock issued upon the exercise of a stock option will be determined by our Board and may include (i) cash or check, bank draft or money order payable to us; (ii) a broker-assisted cashless exercise; (iii) subject to certain conditions, the tender of shares of our Common Stock previously owned by the optionholder; (iv) a net exercise of the option if it is an NSO; or (v) other legal consideration acceptable to our Board.

Unless our Board provides otherwise, options or stock appreciation rights generally will not be transferable except by will or the laws of descent and distribution. Subject to approval of our Board or a duly authorized officer, an option may be transferred pursuant to a domestic relations order.

Limitations on ISOs

The aggregate fair market value, determined at the time of grant, of our Common Stock with respect to ISOs that are exercisable for the first time by an optionholder during any calendar year under all of our stock plans or plans of our affiliates may not exceed $100,000. Options or portions thereof that exceed such limit will generally be treated as NSOs. No ISO may be granted to any person who, at the time of the grant, owns or is deemed to own stock possessing more than 10% of our total combined voting power or that of any of our parent or subsidiary corporations unless (i) the option exercise price is at least 110% of the fair market value of the stock subject to the option on the date of grant; and (ii) the term of the ISO does not exceed five years from the date of grant.

Restricted Stock Unit Awards

Subject to the terms of the Equity Incentive Plan, each restricted stock unit award will have such terms and conditions as determined by our Board. A restricted stock unit award represents a participant’s right to be issued

on a future date the number of shares of our Common Stock that is equal to the number of restricted stock units subject to the award. A participant will not have voting or any other rights as a stockholder of ours with respect to any restricted stock unit award (unless and until shares are actually issued in settlement of a vested restricted stock unit award). A restricted stock unit award will be granted in consideration for a participant’s services to us or an affiliate, such that the participant will not be required to make any payment to us (other than such services) with respect to the grant or vesting of the restricted stock unit award, or the issuance of any shares of Common Stock pursuant to the restricted stock unit award. Our Board may determine that restricted stock unit awards may be granted in consideration for any form of legal consideration that may be acceptable to our Board and permissible under applicable law. A restricted stock unit award may be settled by cash, delivery of stock (or any combination of our Common Stock and cash), or in any other form of consideration determined by our Board and set forth in the restricted stock unit award agreement. At the time of grant, our Board may impose such restrictions or conditions on the award of restricted stock units that delay delivery to a date following the vesting of the award. Additionally, dividend equivalents may be paid or credited in respect of shares of Common Stock covered by a restricted stock unit award. Except as otherwise provided in the applicable award agreement, or other written agreement between us and the recipient, restricted stock unit awards that have not vested will be forfeited once the participant’s continuous service ends for any reason.

Restricted Stock Awards

Restricted stock awards will be granted under restricted stock award agreements adopted by our Board. A restricted stock award may be awarded in consideration for cash, check, bank draft or money order, past services to us or any of our affiliates, or any other form of legal consideration that may be acceptable to our Board and permissible under applicable law. Our Board will determine the terms and conditions of restricted stock awards, including vesting and forfeiture terms. Dividends may be paid or credited with respect to shares subject to a restricted stock award, as determined by our Board and specified in the applicable restricted stock award agreement. If a participant’s service relationship with us ends for any reason, we may receive any or all of the shares of Common Stock held by the participant that have not vested as of the date the participant terminates service with us through a forfeiture condition or a repurchase right.

Stock Appreciation Rights

Stock appreciation rights will be granted under stock appreciation right agreements adopted by our Board and denominated in shares of Common Stock equivalents. The terms of separation stock appreciation rights need not be identical. Our Board will determine the purchase price or strike price for a stock appreciation right, which generally will not be less than 100% of the fair market value of our Common Stock on the date of grant. A stock appreciation right granted under the Equity Incentive Plan will vest at the rate specified in the stock appreciation right agreement as will be determined by our Board. Stock appreciation rights may be settled in cash or shares of our Common Stock (or any combination of our Common Stock and cash) or in any other form of payment, as determined by our Board and specified in the stock appreciation right agreement.

Our Board will determine the term of stock appreciation rights granted under the Equity Incentive Plan, up to a maximum of ten years. If a participant’s service relationship with us or any of our affiliates ceases for any reason other than cause, disability, or death, the participant may generally exercise any vested stock appreciation right for a period of three months following the cessation of service. If a participant’s service relationship with us or any of our affiliates ceases due to death, or a participant dies within a certain period following cessation of service, the participant or a beneficiary may generally exercise any vested stock appreciation rights for a period of 18 months following the date of death. If a participant’s service relationship with us or any of our affiliates ceases due to disability, the participant may generally exercise any vested stock appreciation rights for a period of 12 months following the cessation of service. In the event of a termination for cause, stock appreciation rights generally terminate upon the termination date. A holder of a stock appreciation right may not exercise a stock appreciation right at any time that the issuance of shares upon such exercise would violate applicable law. Unless provided otherwise in the stock appreciation right agreement or other written agreement between the participant

and us, if a participant’s service relationship with us or any of our affiliates ceases for any reason other than for cause and, at any time during the last thirty days of the applicable post-termination exercise period: (i) the exercise of the participant’s stock appreciation right would be prohibited solely because the issuance of shares upon such exercise would violate applicable law, or (ii) the immediate sale of any shares issued upon such exercise would violate our trading policy, then the applicable post-termination exercise period will be extended to the last day of the calendar month that begins after the date the award would otherwise expire, with an additional extension of the exercise period to the last day of the next calendar month to apply if any of the foregoing restrictions apply at any time during such extended exercise period. There is no limitation as to the maximum permitted number of extensions. However, in no event may a stock appreciation right be exercised beyond the expiration of its term.

Performance Awards

The Equity Incentive Plan will permit the grant of performance awards that may be settled in stock, cash or other property. Performance awards may be structured so that the stock or cash will be issued or paid only following the achievement of certain pre-established performance goals during a designated performance period. Performance awards that are settled in cash or other property are not required to be valued in whole or in part by reference to, or otherwise based on, our Common Stock. The performance goals may be based on any measure of performance selected by our Board. The performance goals may be based on company-wide performance or performance of one or more business units, divisions, affiliates, or business segments, and may be either absolute or relative to the performance of one or more comparable companies or the performance of one or more relevant indices. Unless specified otherwise by our Board at the time the performance award is granted, our Board will appropriately make adjustments in the method of calculating the attainment of performance goals for a performance period as follows: (i) to exclude restructuring and/or other nonrecurring charges; (ii) to exclude exchange rate effects; (iii) to exclude the effects of changes to generally accepted accounting principles; (iv) to exclude the effects of any statutory adjustments to corporate tax rates; (v) to exclude the effects of items that are “unusual” in nature or occur “infrequently” as determined under generally accepted accounting principles; (vi) to exclude the dilutive effects of acquisitions or joint ventures; (vii) to assume that any business divested by us achieved performance objectives at targeted levels during the balance of a performance period following such divestiture; (viii) to exclude the effect of any change in the outstanding shares of our Common Stock by reason of any stock dividend or split, stock repurchase, reorganization, recapitalization, merger, consolidation, spin-off, combination or exchange of shares or other similar corporate change, or any distributions to common stockholders other than regular cash dividends; (ix) to exclude the effects of stock based compensation and the award of bonuses under our bonus plans; (x) to exclude costs incurredregistration statements filed in connection with potential acquisitions or divestitures that are required to be expensed under generally accepted accounting principles; and (xi) to exclude the goodwill and intangible asset impairment charges that are required to be recorded under generally accepted accounting principles.

Our Board retains the discretion to reduce or eliminate the compensation or economic benefit due upon attainment of performance goals and to define the manner of calculating the performance criteria it selects to use for the performance period. Partial achievement of the specified criteria may result in the payment or vesting corresponding to the degree of achievement as specified in the performance award agreement or the written terms of a performance cash award. Our Board will determine the length of any performance period, the performance goals to be achieved during a performance period and the other terms and conditions of such awards.

Other Stock Awards

Our Board will be permitted to grant other awards, based in whole or in part by reference to, or otherwise based on, our Common Stock, either alone or in addition to other awards. Our Board will have the sole and complete discretion to determine the persons to whom and the time or times at which other stock awards will be granted, the number of shares under the other stock award (or cash equivalent) and all other terms and conditions of such awards.

Non-Employee Director Compensation Limit

The aggregate value of all compensation granted or paid following the effective date of the Equity Incentive Plan to any individual for service as a non-employee director with respect to any fiscal year, including awards granted under the Equity Incentive Plan (valued based on the grant date fair value for financial reporting purposes) and cash fees paid by us to such non-employee director, will not exceed $750,000 in total value, except such amount will increase to $1,000,000 for the year in which a non-employee director is first appointed or elected to our Board.

Changes to Capital Structure

In the event there is a specified type of change in our capital structure, such as a stock split, reverse stock split, or recapitalization, our Board will appropriately and proportionately adjust (i) the class(es) and maximum number of shares subject to the Equity Incentive Plan and the maximum number of shares by which the share reserve may annually increase pursuant to the Equity Incentive Plan; (ii) the class(es) and maximum number of shares that may be issued on the exercise of ISOs; and (iii) the class(es) and number of shares and exercise price, strike price, or purchase price, if applicable, of all outstanding awards granted under the Equity Incentive Plan.

Corporate Transactions

In the event of a corporate transaction (as defined below), unless otherwise provided in a participant’s award agreement or other written agreement with us or one of our affiliates or unless otherwise expressly provided by our Board at the time of grant, any awards outstanding under the Equity Incentive Plan may be assumed, continued or substituted for, in whole or in part, by any surviving or acquiring corporation (or its parent company), and any reacquisition or repurchase rights held by us with respect to our Common Stock issued pursuant to awards may be assigned to the successor (or its parent company). If the surviving or acquiring corporation (or its parent company) does not assume, continue or substitute for such awards, then (i) with respect to any such awards that are held by participants whose continuous service has not terminated prior to the effective time of the corporate transaction, or current participants, the vesting (and exercisability, if applicable) of such awards will be accelerated in full (or, in the case of performance awards with multiple vesting levels depending on the level of performance, unless provided otherwise in the applicable award agreement, vesting will accelerate at 100% of the target level) to a date prior to the effective time of the corporate transaction (contingent upon the effectiveness of the corporate transaction) as our Board determines (or, if our Board does not determine such a date, to the date that is five days prior to the effective time of the corporate transaction), and such awards will terminate if not exercised (if applicable) at or prior to the effective time of the corporate transaction, and any reacquisition or repurchase rights held by us with respect to such awards will lapse (contingent upon the effectiveness of the corporate transaction); and (ii) any such awards that are held by persons other than current participants will terminate if not exercised (if applicable) prior to the occurrence of the corporate transaction, except that any reacquisition or repurchase rights held by us with respect to such awards will not terminate and may continue to be exercised notwithstanding the corporate transaction.

In the event an award will terminate if not exercised prior to the effective time of a corporate transaction, our Board may provide, in its sole discretion, that the holder of such award may not exercise such award but instead will receive a payment, in such form as may be determined by our Board, equal in value to the excess (if any) of (i) the value of the property the participant would have received upon the exercise of the award, over (ii) any per share exercise price payable by such holder, if applicable. As a condition to the receipt of an award, a participant will be deemed to have agreed that the award will be subject to the terms of any agreement under the Equity Incentive Plan governing a corporate transaction involving us.

Under the Equity Incentive Plan, a “corporate transaction” generally will be the consummation, in a single transaction or in a series of related transactions, of (i) a sale or other disposition of all or substantially all, as determined by our Board, of the consolidated assets of us and our subsidiaries; (ii) a sale or other disposition of at least 50% of our outstanding securities; (iii) a merger, consolidation or similar transaction following which we are not the surviving corporation; or (iv) a merger, consolidation or similar transaction following which we are

the surviving corporation but the shares of our Common Stock outstanding immediately prior to such transaction are converted or exchanged into other property by virtue of the transaction.

Transferability

Except as expressly provided in the Equity Incentive Plan or the form of award agreement, awards granted under the Equity Incentive Plan may not be transferred or assigned by a participant. After the vested shares subject to an award have been issued, or in the case of a restricted stock award and similar awards, after the issued shares have vested, the holder of such shares is free to assign, hypothecate, donate, encumber or otherwise dispose of any interest in such shares provided that any such actions are in compliance with the provisions herein, the terms of our trading policy and applicable law.

Clawback/Recovery

All awards granted under the Equity Incentive Plan will be subject to recoupment in accordance with any clawback policy that we are required to adopt pursuant to the listing standards of any national securities exchange or association on which our securities are listed or as is otherwise required by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other applicable law and any clawback policy that we otherwise adopt, to the extent applicable and permissible under applicable law. In addition, our Board may impose such other clawback, recovery or recoupment provisions in an award agreement as our Board determines necessary or appropriate, including, but not limited to, a reacquisition right in respect of previously acquired shares of Common Stock or other cash or property upon the occurrence of cause.

Amendment or Termination

Our Board may accelerate the time at which an award granted under the Equity Incentive Plan may first be exercised or the time during which an award grant under the Equity Incentive Plan or any part thereof will vest, notwithstanding the provisions in the award agreement stating the time at which it may first be exercised or the time during which it will vest. Our Board will have the authority to amend, suspend, or terminate the Equity Incentive Plan at any time, provided that such action does not materially impair the existing rights of any participant without such participant’s written consent. Certain material amendments will also require the approval of our stockholders. No ISOs may be granted after the tenth anniversary of the date our Board adopts the Equity Incentive Plan. No awards may be granted under the Equity Incentive Plan while it is suspended or after it is terminated.

Federal Income Tax Consequences Associated with the Equity Incentive Plan

The following is a general summary under current law of the material federal income tax consequences to participants in the Equity Incentive Plan. This summary deals with the general tax principles that apply and is provided only for general information. Some kinds of taxes, such as state, local and foreign income taxes and federal employment taxes, are not discussed. Tax laws are complex and subject to change and may vary depending on individual circumstances and from locality to locality. The summary does not discuss all aspects of income taxation that may be relevant in light of a holder’s personal investment circumstances. This summarized tax information is not tax advice.

Nonstatutory Stock Options. For federal income tax purposes, if an optionee is granted an NSO under the Equity Incentive Plan, the optionee will not have taxable income on the grant of the option, nor will we be entitled to any deduction. Generally, upon exercise of NSOs, the optionee will recognize ordinary income, and we will be entitled to a deduction, in an amount equal to the excess of the fair market value of a share of our Common Stock over the option exercise price on the date each such option is exercised. The optionee’s basis for the stock for purposes of determining gain or loss on subsequent disposition of such shares generally will be the fair market value of our Common Stock on the date the optionee exercises such option. Any subsequent gain or loss will be generally taxable as capital gains or losses.

Incentive Stock Options. There is no taxable income to an optionee when an optionee is granted an ISO or when that option is exercised. However, the amount by which the fair market value of the shares at the time of exercise exceeds the option price will be an “item of adjustment” for the optionee for purposes of the alternative minimum tax. Gain realized by the optionee on the sale of an ISO is taxable at capital gains rates, and no tax deduction is available to us, unless the optionee disposes of the shares within (a) two years after the date of grant of the option or (b) within one year of the date the shares were transferred to the optionee. If the shares acquired upon exercise of the ISO are sold or otherwise disposed of before the end of the two-year and one-year periods specified above, the excess of the fair market value of a share of our Common Stock over the option exercise price on the date of the option’s exercise will be taxed at ordinary income rates (or, if less, the gain on the sale), and we will be entitled to a deduction to the extent the optionee must recognize ordinary income. If such a sale or disposition takes place in the year in which the optionee exercises the option, the income the optionee recognizes upon sale or disposition of the shares will not be considered an item of adjustment for alternative minimum tax purposes.

An ISO exercised more than three months after an optionee terminates employment, for reasons other than death or disability, will be taxed as an NSO, and the optionee will recognize ordinary income on the exercise. We will be entitled to a tax deduction equal to the ordinary income, if any, realized by the optionee.

Restricted Stock. An individual to whom restricted stock is issued generally will not recognize taxable income upon such issuance, and we generally will not then be entitled to a deduction, unless an election is made by the participant under Section 83(b) of the Code (“Section 83(b)”). However, when restrictions on shares of restricted stock lapse, such that the shares are no longer subject to a substantial risk of forfeiture, the individual generally will recognize ordinary income, and we generally will be entitled to a deduction for an amount equal to the excess of the fair market value of the shares at the date such restrictions lapse over the purchase price. If a timely election is made under Section 83(b) with respect to restricted stock, the participant generally will recognize ordinary income on the date of the issuance equal to the excess, if any, of the fair market value of the shares at that date over the purchase price of such shares, and we will be entitled to a deduction for the same amount.

Stock Appreciation Rights. A participant will not be taxed upon the grant of a stock appreciation right. Upon the exercise of the stock appreciation right, the participant will recognize ordinary income equal to the amount of cash or the fair market value of the stock received upon exercise. At the time of exercise, we will be eligible for a tax deduction as a compensation expense equal to the amount that the participant recognizes as ordinary income.

Performance Awards and Other Stock Awards. The participant will have ordinary income upon receipt of stock or cash payable under performance awards, dividend equivalents, restricted stock units and stock payments. We will be eligible for a tax deduction as a compensation expense equal to the amount of ordinary income recognized by the participant.

Section 162(m) of the Code. Section 162(m) of the Code generally limits to $1.0 million the amount of compensation that we may deduct in any calendar year for certain current and former executive officers. For grants under the Equity Incentive Plan, we will not be able to take a deduction for any compensation in excess of $1.0 million that is paid to a covered officer.

Requirements of Section 409A of the Code. Certain awards under the Equity Incentive Plan may be considered “nonqualified deferred compensation” for purposes of Section 409A of the Code (“Section 409A”), which imposes certain requirements on compensation that is deemed under Section 409A to involve nonqualified deferred compensation. Among other things, the requirements relate to the timing of elections to defer, the timing of distributions and prohibitions on the acceleration of distributions. Failure to comply with these requirements (or an exception from such requirements) may result in the immediate taxation of all amounts deferred under the nonqualified deferred compensation plan for the taxable year and all preceding taxable years, by or for any participant with respect to whom the failure relates, the imposition of an additional 20% income tax on the participant for the amounts required to be included in gross income and the possible imposition of penalty interest on the unpaid tax. Generally, Section 409A does not apply to incentive awards that are paid at the time the award vests. Likewise, Section 409A typically does not apply to restricted stock. Section 409A may,

however, apply to incentive awards the payment of which is delayed beyond the calendar year in which the award vests. Treasury regulations generally provide that the type of awards provided under the Equity Incentive Plan will not be considered nonqualified deferred compensation. However, to the extent that Section 409A applies to an award issued under the Equity Incentive Plan, the Equity Incentive Plan and all such awards will, to the extent practicable, be construed in accordance with Section 409A. Under the Equity Incentive Plan, the administrator has the discretion to grant or to unilaterally modify any award issued under the Equity Incentive Plan in a manner that conforms with the requirements of Section 409A with respect to deferred compensation or voids any participant election to the extent it would violate Section 409A. The administrator also has sole discretion to interpret the requirements of the Code, including Section 409A, for purposes of the Equity Incentive Plan and all awards issued under the Equity Incentive Plan.

New Plan Benefits

Future awards, if any, that will be made to eligible persons under the Equity Incentive Plan are subject to the discretion of the administrator and, therefore, we cannot currently determine the benefits or number of shares of our Common Stock subject to awards that may be granted in the future to our employees, directors and consultants under the Equity Incentive Plan. No awards have been granted that are contingent on the approval of the Plan Amendment.

For illustrative purposes only, the following table sets forth (i) the aggregate number of shares subject to options granted under the Equity Incentive Plan since the closing of the Business Combination, when such plan became effective,standalone audits, consultation on accounting matters, and SEC registration statement services. The 2022 audit fees for Ernst & Young LLP also include fees of $1,368,000 related to our named executive officers, to all current executive officers, as a group, to all directors who are not executive officers, as a group, and to all employees who are not executive officers, as a group (even if not currently outstanding) and (ii)services performed in connection with the weighted-average per share exercise price of such options.Business Combination, which was completed in November 2022.

| | | | | | | | | | Name of Individual or Group and Position | | Number

of Shares

Subject to

Options | | | Weighted-

Average

Per Share

Exercise Price ($) | | Jaisim Shah Chief Executive Officer, President and Director | | | 1,700,000 | | | $ | 8.08 | | Henry Ji, Ph.D. Executive Chairperson | | | 9,000,000 | | | $ | 8.08 | | Elizabeth Czerepak Executive Vice President, Chief Business Officer, Chief Financial Officer and Secretary | | | 350,000 | | | $ | 8.08 | | All current executive officers, as a group (3 persons) | | | 11,050,000 | | | $ | 8.08 | | All current directors who are not current executive officers, as a group (5 persons) | | | 1,250,000 | | | $ | 8.08 | | All employees who are not current executive officers, as a group (approximately 93 persons as of March 1, 2023) | | | 2,495,000 | | | $ | 8.08 | |

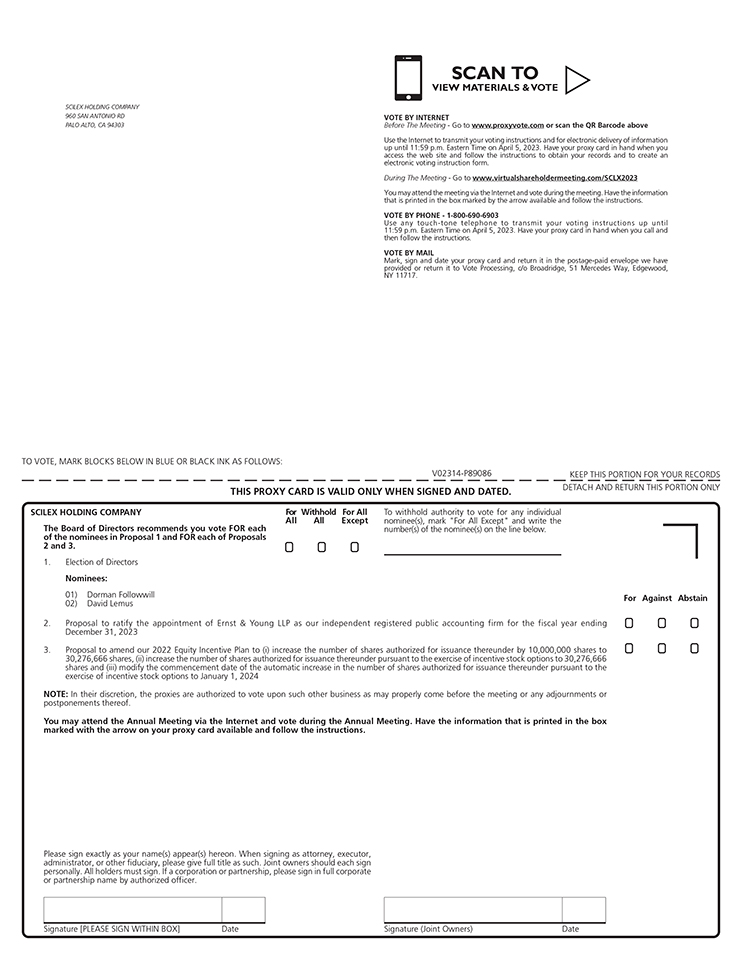

Vote Required

The approval of the Plan Amendment requires the affirmative vote of the majority of the shares of our Common Stock and Series A Preferred Stock present by remote communication or represented by proxy at the Annual Meeting and entitled to vote thereon. Stockholder abstentions will not have any effect on the outcome of this proposal, so long as a quorum exists. Broker non-votes will have no effect on the outcome of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE AMENDMENT TO THE SCILEX HOLDING COMPANY 2022 EQUITY INCENTIVE PLAN TO

(I) INCREASE THE NUMBER OF SHARES AUTHORIZED FOR ISSUANCE THEREUNDER BY 10,000,000 SHARES TO 30,276,666 SHARES, (II) INCREASE THE NUMBER OF SHARES AUTHORIZED FOR ISSUANCE THEREUNDER PURSUANT TO THE EXERCISE OF INCENTIVE STOCK OPTIONS TO 30,276,666 SHARES, AND (III) MODIFY THE COMMENCEMENT DATE OF THE AUTOMATIC INCREASE IN THE NUMBER OF SHARES AUTHORIZED FOR ISSUANCE THEREUNDER PURSUANT TO THE EXERCISE OF INCENTIVE STOCK OPTIONS TO JANUARY

|